Get Out of Debt. Reclaim Control of Your Financial Future (Without Sacrificing Your Lifestyle)

After getting out of $215,000 of non-mortgage debt myself, I can help you overcome the emotional and financial challenges of debt, so you can build the life you deserve.

Are You Earning Well but Still Struggling with Debt?

Even with a high income, debt can feel overwhelming (trust me, I know). Credit card balances, student loans, car loans, and lifestyle expenses add up. It’s frustrating to work hard yet feel like you’re always behind financially, but let me say you’re not alone, and it doesn’t have to be this way.

This is for you if you are dealing with one or many of the following:

- You can’t move on with your life (i.e. start a family, buy a home, or get ahead) because of debt and payments.

- Stress about debt despite a solid paycheck. You ask yourself “where is the money going?” constantly.

- You fear never being able to get ahead financially, always living paycheck to paycheck, and not being able to get out of debt.

- You deal with emotional challenges that are leading you to fall off track no matter how many apps or spreadsheet you are using.

- You struggle with being accountable to yourself and you need someone who’s been there who can help you and give you support

- You can’t help but spend money on spending more money as your income grows (lifestyle inflation).

- Feeling embarrassed that you can’t seem to control your finances.

You’ve worked hard to earn what you have, now it’s time to make sure you keep it.

Step-by-Step Debt-Free Plan Tailored for High-Income Professionals

I know what it’s like to feel weighed down by debt while earning a good salary. I was once in your shoes; juggling credit cards, car loans, and massive student loans. I found a way out, and I’m here to help you do the same.

Through my proven debt-elimination plan, you will:

- Take control of your finances with a clear, structured plan.

- Eliminate debt faster than you thought possible, without sacrificing your lifestyle.

- Build long-term financial security for yourself and your family.

How It Works:

- Financial Health Assessment and Debt Audit: We’ll analyze your current financial situation and identify the biggest areas of improvement (and what you’re doing well).

- Custom Debt Plan: I’ll create a personalized, step-by-step plan that outlines exactly how to tackle your debt while keeping your lifestyle intact.

- Ongoing Accountability: Stay on track with three check-ins and support to ensure you reach your debt-free goals.

- Wealth-Building Strategies: Once debt is eliminated, I’ll show you how to shift your income toward building wealth and securing your future.

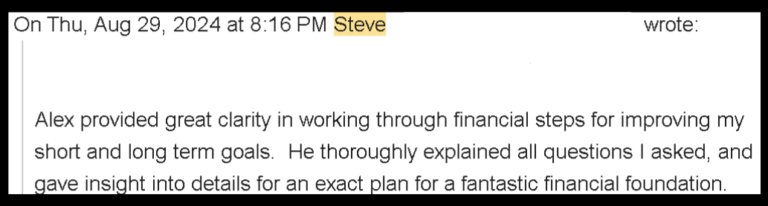

here's what one of my clients said:

Steve came to be feeling behind, stressed, overwhelmed and uncertain about the future. He told me “I don’t want to be 40 years old and regret the decisions I’m making right now.”

Just how I helped Steve gain clarity, I can help you achieve the same.

WHY WORK WITH ME

Here’s the bottom line: I’ve been in your shoes. I know what it’s like to make good money and be in thousands of dollars in debt.

My wife and I a few years ago came to the realization that if we did not get out of the debt we had, our goals of growing our family, and moving on to the next stage of our lives was never going to happen.

As we were in our late 20s, we wanted to start having kids, get a bigger car, move to a bigger home for our family, but the problem was DEBT, which was sitting right in the middle of us and our dreams. We were buried under $215,000 in debt, despite having great jobs.

Growing up with no financial education, we had to figure everything out on our own; it was overwhelming. Stress, uncertainty, and analysis paralysis can keep you stuck.

Through setting goals, building the right mindset and approach, becoming disciplined, and keeping each other accountable with the right strategies, we were able to overcome our debt in 2.5 years.

Now, we’re debt-free, investing in our future, and living with financial peace of mind. Here’s what we’ve achieved, and what I can help YOU achieve too:

- CRUSH crippling debt once and for all, and use your money to build wealth

- Overcome comparison, FOMO, and other emotional challenges leading you to overspending

- Set clear financial goals and know exactly how to get there.

- Financial alignment with your partner; both of you on the same page, working toward shared goals.

- Build your emergency find to cover unexpected medical expenses without getting into debt

- Investing in retirement accounts and securing a stable financial future.

We built this life by following the right steps, and I want the same for you.

If you’re not there yet, let’s get you there. This is your chance to take control of your financial future!

requirements

I want to make sure you have the best experience. The satisfaction of my clients is my number one priority. For this, there are certain requirements you need to meet before you apply for a consultation call:

- You must be a working professional, or a family, living in the USA, and have an income coming in.

- You must be sick and tired of debt weighing you down and holding you back from reaching your biggest financial dreams and goals!

- You must be serious, driven, dedicated, responsible, open, and punctual.

- You must be available for video calls.

risk-free

I’m confident that our session will give you the clarity and tools you need to start making major financial progress. But if, for any reason, you feel you don’t reach the goals we set together, I will personally refund 100% of your money. This is a no-risk offer and your satisfaction is my biggest priority.

Ready to Transform Your Financial Future?

Don’t leave your financial future to chance. In just 60 minutes, you can go from financial stress and confusion to clarity, control, and confidence.

You can take control of your money in less time than you think, and with much less effort than you expect.

Frequently Asked Questions (faqs)

How is this different from other debt-elimination programs?

My program is designed specifically for high-income professionals who need a personalized, practical plan. We focus on eliminating debt without having to go back to living like a college student (I don’t believe in “rice and beans.” My approach is methodical, adjustable, and will help you eliminate debt as fast and as efficiently as possible.

Will I have to cut my spending drastically?

There must be changes to your lifestyle, but what I’ve come to understand is for many high income professionals who are in debt, the problem is not just math, is also emotional. That’s why, not only will we focus on optimizing your current spending, and income to maximize debt reduction, we’ll also address the mental and emotional challenges that come with being in debt (comparison, FOMO, toxic relationship with money, etc.). Not only will we make financial changes, also mindset.

How quickly can I expect results?

You can expect results within the first week. However, results vary depending on your unique financial situation.